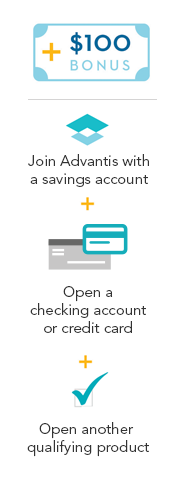

How the Offer Works

The power of three

Boost your Advantis membership by opening a checking account or credit card and one qualifying product (money market savings, CD, IRA, credit card, checking account or any type of loan) within six months of membership opening. And that’s it. Easy peasy, enjoy your $100*.

It’s our way of saying thanks for joining Advantis.

Everything (and we mean everything!) you need to know

*$100 New Member Offer may be discontinued at any time without notice. Offer only valid for new Advantis Credit Union members (i.e. Individuals without an Advantis membership in the previous 6 months) and must be 18 years of age or older. To qualify for bonus, open a regular or business savings account and be designated as the primary owner/signer on the qualifying consumer or business checking account and any “additional account” including; consumer or business Certificates of Deposit, consumer or business Money Market, Consumer IRA Savings, HSA Certificates, Holiday & Tax Savings account, My First Home Savings or any type of Consumer or Commercial loan, or any type of consumer credit card (Opening a second checking account, or a second credit card, does not qualify as an additional account). $100 bonus will be treated as interest for tax reporting purposes. The account and qualifying products must be opened within 6 months after opening of the membership, been funded and in good standing. Limit one $100 bonus per primary Tax Identification Number. Any bonus offered to a member for opening, adding to, or maintaining an account, the IRS defines this as interest.

Savings |

Rates Effective 11/11/1111 |

| Product | Tier | Annual Percentage Yield (APY) |

|---|---|---|

| New Member Savings* | $0 - $499.99 | 4.75% |

| $500 - $2,499.99 | 4.75% | |

| $2,500 - $9,999.99 | 4.75% | |

| $10,000 or more | 4.75% | |

| Regular Savings | $0 - $499.99 | 0.00% |

| $500 - $2,499.99 | 0.05% | |

| $2,500 - $9,999.99 | 0.05% | |

| $10,000 or more | 0.05% | |

| Holiday and Tax Account | $0 - $499.99 | 0.00% |

| $500 - $2,499.99 | 0.05% | |

| $2,500 - $9,999.99 | 0.05% | |

| $10,000 or more | 0.05% | |

| Youth Account | n/a | 0.05% |

| Start Savings Account | $0.01–$500 | 1.00% |

| $500.01 or more | 0.05% |

The APY may change after account opening. Minimum amount to open a New Member Savings, Regular Savings, Youth Savings, Start Savings or Holiday and Tax Account is $5.

New Member Savings available to new members only, existing members are not eligible for the New Member Savings. One account per member. “New Members” are individuals or businesses that have not had an account as primary owner within the previous 6 months. To qualify for the New Member Savings, you must be a new member, open and maintain, in good standing, a qualified Advantis checking account and maintain a monthly direct deposit (ACH) of at least $100 to your Advantis checking account. The direct deposit must post and settle within each calendar month. New Member Savings account requirements are waived for your first statement cycle. When New Member Savings requirements are met, balances will earn a higher interest rate than the regular savings account for 12 months from the date the membership is opened. The account will automatically convert to Regular Savings on the last day of the calendar month following the 12 months from opening your New Member Savings. If you fail to meet the monthly requirements your account will be permanently converted to a Regular Saving account on the last day of the calendar month that qualifications were not met, and you will not qualify for the New Member Savings rate. Qualified checking accounts include any Advantis checking except HSA checking accounts.

You must be between the ages of 14 to 22 years old in order to qualify for the Start Savings account. Only one Start Savings account per member and member number (membership). No Primary member can have two Start Savings accounts (they can be joint on another account that has a different primary member.) For Start Savings accounts, on the first day of the month following your 23rd birthday, your account will convert to a Regular Savings account. Transaction restrictions apply.

Checking |

Rates Effective 11/11/1111 |

| Product | Tier | Annual Percentage Yield (APY) |

|---|---|---|

| Fusion Checking | $0.01 - $10,000 | 2.00%1 |

| $10,000.01 - $25,000 | 1.50%1 | |

| $25,000.01 or more | 0.10%1 | |

| Start Checking | n/a | n/a3 |

| Cashback Checking | n/a | n/a4 |

| HSA Interest Checking | $0 - $2,499.99 | 0.05%5 |

| $2,500 - $9,999.99 | 0.05%5 | |

| $10,000 or more | 0.05%5 |

2Minimum amount to open a Start Checking is $25. To earn cash back you must be signed up to receive eStatements from Advantis. You will earn $0.10 on every qualifying purchase that posts during the account cycle. A qualifying purchase is a purchase of $3.00 or more that is made with the debit card tied to your Start Checking account, including purchases made with your card through a Digital Wallet supported by Advantis and purchases made with your debit card online. For purposes of the Start Checking account, the account cycle runs from the first day of the month to the last day of the month. Your cashback will be posted to your Start Checking account on the first day of the month following the close of the account cycle. You will not receive any cashback for any purchases posted during the same month you close your account. You must be between the ages of 14 to 22 years old in order to qualify for the Start Checking account. On the first day of the month following your 23rd birthday, your Start Checking account will convert to a Cashback Checking account.

3 Minimum to open a Cash Back Checking is $25. Your cash back will be posted to your Cashback Checking account on the first day of the month following the close of the account cycle. The account cycle runs from the first day of the month to the last day of the month. If you close your Cashback Checking account, you will not receive any cash back for purchases posted during the month you close your account. Only applicable to purchases made with your debit card tied to your Cashback Checking account.

4The APY may change after account opening. Fees may reduce earnings. Contribution limits apply. Consult your tax advisor for specific tax information.

IRAs |

Rates Effective 11/11/1111 |

| Product | Tier | Annual Percentage Yield (APY) |

|---|---|---|

| High-Growth IRA | $0.00-$24,999 | 0.05% |

| $25,000–$49,999 | 0.10% | |

| $50,000–$99,999 | 0.10% | |

| $100,000 or more | 0.10 % |

Money Market |

Rates Effective 11/11/1111 |

| Tier | Annual Percentage Yield (APY) |

|---|---|

| $0.01–$9,999.99 | 0.25% |

| $10,000–$24,999.99 | 0.25% |

| $25,000–$99,999 | 0.50% |

| $100,000–$249,999 | 1.00% |

| $250,000 or more |

1.00% |

High-Growth CDs1 |

Rates Effective 11/01/2020 | |

| Term | $500-$49,999.99 | $50,000 – $99,999.99 | $100,000 or more |

|---|---|---|---|

| 6 Months | 1.70% APY | 1.70% APY | 1.70% APY |

| 12 Months | 3.00% APY | 3.00% APY | 3.00% APY |

| 24 Months | 2.10% APY | 2.10% APY | 2.10% APY |

| 36 Months | 2.20% APY | 2.20% APY | 2.20% APY |

| 48 Months | 2.30% APY | 2.30% APY | 2.30% APY |

| 60 Months | 2.35% APY | 2.35% APY | 2.35% APY |

Featured Offers

| Product | Amount | Interest Rate | Annual Percentage Yield (APY) |

|---|---|---|---|

| 12 Month Certificate | $500–$49,999.99 $50,000–$99,999.99 $100,000 or more |

2.96%

2.96%

2.96%

|

3.00%

3.00%

3.00%

|

Health Savings Account Certificate1 |

Rates Effective 11/01/2020 | ||

|---|---|---|---|

| Term | $500 – $49,999 | $50,000 – $99,999 | $100,000 or more |

| 6 Months | 1.70% APY | 1.70% APY | 1.70% APY |

| 12 Months | 4.50% APY | 4.50% APY | 3.00% APY |

| 24 Months | 2.10% APY | 2.10% APY | 2.10% APY |

| 36 Months | 2.20% APY | 2.20% APY | 2.20% APY |

Business Rates

Business Checking1 |

Rates Effective 11/01/2020 |

|---|---|

| TIER | ANNUAL PERCENTAGE YIELD (APY*) |

| under $2,500 | 0.05% |

| $2,500 - $24,999 | 0.05% |

| $25,000 - $49,999 | 0.05% |

| $50,000 or more | 0.05% |

Business Savings1 |

Rates Effective 11/01/2020 |

|---|---|

| TIER | ANNUAL PERCENTAGE YIELD (APY*) |

| under $500 | 0.00% |

| $500 - $2,499 | 0.05% |

| $2,500 - $9,999 | 0.05% |

| $10,000 or more | 0.05% |

Business Money Market1 |

Rates Effective 11/01/2020 |

|---|---|

| TIER | ANNUAL PERCENTAGE YIELD (APY*) |

| under $2,500 | 0.00% |

| $2,500 - $9,999.99 | 0.25% |

| $10,000 - $24,999.99 | 0.25% |

| $25,000 - $99,999.99 | 0.50% |

| $100,000 - $249,999.99 | 1.00% |

| $250,000 or more | 1.00% |

Business Certificates1 |

Rates Effective 11/01/2020 | ||

|---|---|---|---|

| Term | $500-$49,999.99 | $50,000 – $99,999.99 | $100,000 or more |

| 6 Months | 1.70 % APY | 1.70 % APY | 1.70 % APY |

| 12 Months | 3.00% APY | 3.00% APY | 3.00% APY |

| 24 Months | 2.10% APY | 2.10% APY | 2.10% APY |

| 36 Months | 2.20% APY | 2.20% APY | 2.20% APY |

| 48 Months | 2.30% APY | 2.30% APY | 2.30% APY |

| 60 Months | 2.35% APY | 2.35% APY | 2.35% APY |

Featured Offers

| Product | Amount | Interest Rate | Annual Percentage Yield (APY) |

|---|---|---|---|

| 12 Month Certificate | $500–$49,999.99 $50,000–$99,999.99 $100,000 or more |

2.96%

2.96%

2.96%

|

3.00%

3.00%

3.00%

|