What else should I know about Credit Insights?

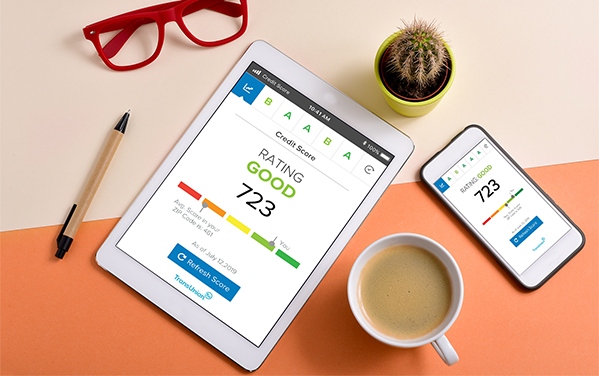

Credit Insights, powered by SavvyMoney, is a comprehensive program offered by Advantis to help you stay on top of your credit. You get your latest credit score and report, an understanding of key factors that impact the score, and can see the most up to date offers that can help reduce your interest costs.

Credit Insights also monitors your credit report daily and can let you know if there are any big changes detected, like a new account being opened, change in address or employment, a delinquency has been reported, or an inquiry has been made. Monitoring also lets you keep an eye out for identity theft.

How often is my credit score updated?

As long as you are a regular Online Banking user, your credit score will be updated every month and displayed in your online banking screen.

Will accessing Credit Insights ‘ping’ my credit and potentially lower my score?

Absolutely not! Checking Credit Insights is a “soft inquiry,” which does not affect your credit score. Lenders use “hard inquiries” to make decisions about your credit worthiness when you apply for loans.

How does the Credit Insights credit score differ from other credit scoring offerings?

Credit Insights pulls your credit profile from TransUnion, one of the three major credit reporting bureaus, and uses VantageScore 3.0, a credit scoring model developed collaboratively by the three major credit bureaus: Equifax, Experian, and TransUnion. This model seeks to make score information more uniform between the three bureaus to provide consumers a better picture of their credit health.

Why do credit scores differ?

There are three major credit reporting bureaus – Equifax, Experian and TransUnion – and two scoring models – FICO and VantageScore – that determine credit scores. Financial institutions use different bureaus, as well as their own scoring models. Over 200 factors of a credit report may be taken into account when calculating a score and each model may weight credit factors differently, so no scoring model is completely identical. No matter what credit bureau or credit scoring model is used, consumers do fall into specific credit ranges:

A+ 730 – 850

A 680 – 729

B 640 – 679

C 600 – 639

D 550 – 599

E 549 and below

What if I see something wrong or inaccurate in my Credit Insights information?

Credit Insights makes its best effort to show you the most relevant information from your credit report. If you think that some of the information is wrong, we encourage you to click the ‘Dispute Report’ button within the Credit Insights widget in Online Banking to dispute any inaccuracies.

Does Advantis use my Credit Insights score when making my loan decisions?

No, Advantis uses our own lending criteria for making loan decisions.

If Advantis doesn’t use my Credit Insights score, why do you offer it?

Because we think information is power. So we offer Credit Insights as a free service to help you manage your credit on a regular basis. So when it comes time to borrow for a big-ticket purchase — like buying a home, car, or paying for college — you have a clear picture of your credit health right from the start.