Frequently asked questions

How do I activate my card?

If you recently received a new Advantis Visa card, you can securely activate it by calling 1-888-691-8661.

What if my credit card is lost or stolen?

Notify us immediately.

- Call 503-785-2528 or 800-547-5532, 8am - 6pm.

- Only the card reported lost/stolen will be blocked.

- Contact local law enforcement and report your loss. Record your report case number, and the name of person taking the report. We may ask you for this information.

What if I think someone has stolen my identity?

Visit our identity theft page for more information. If you have further questions or would like to speak to a Member Service Representative, please call us at 503-785-2528 or email us.

How can I view my credit card balance info, transaction history, or set other controls?

Log in to Advantis Online & Mobile Banking to manage your account activity and card controls.

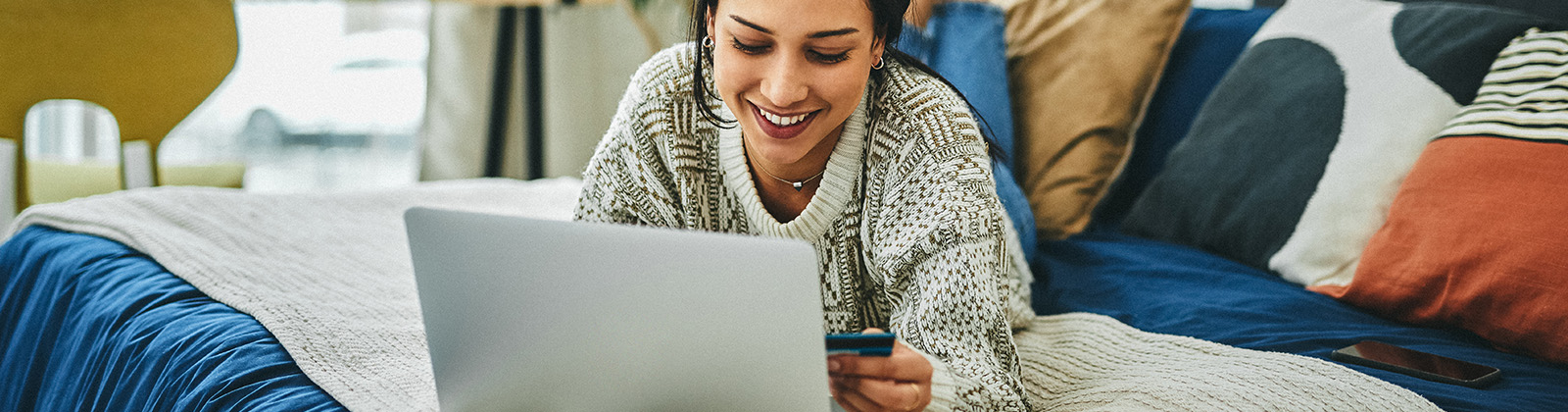

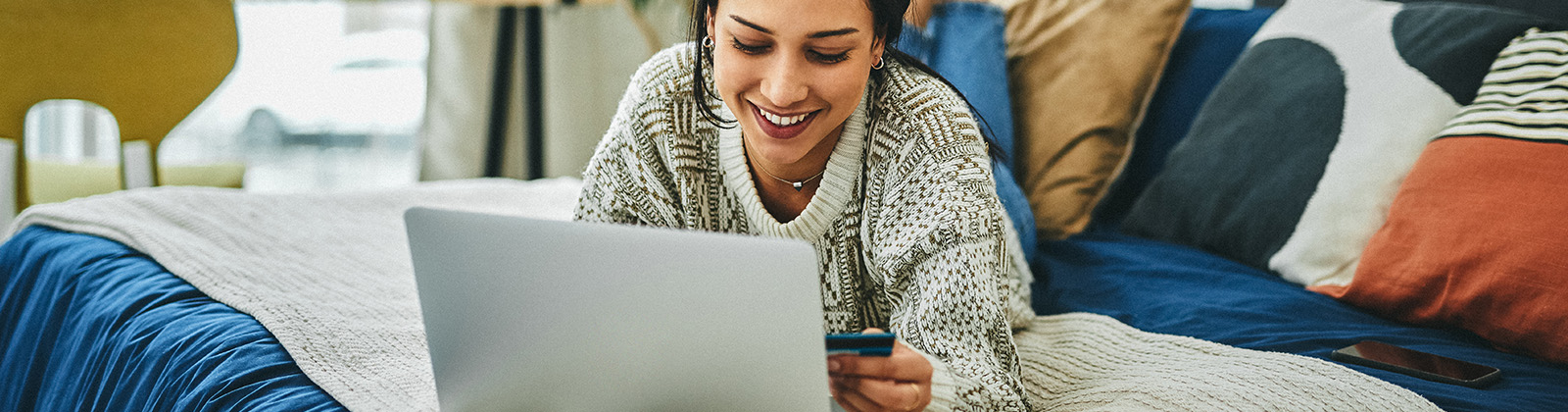

How can I make a credit card payment?

The fastest way to make a credit card payment is through Online & Mobile Banking. Your payment posts to the credit card and increases the amount available to spend immediately.

Please note it may take up to two business days to reflect the payment in your online banking account history. Other convenient payment options are also available.

How long will it take for my new Advantis credit card to arrive?

You'll receive your card in the mail within 14 days after you're approved.