Article: Tax Statements, Refunds & Payments

Happy New Year! We know many of you are already preparing for tax season. Way to go!

Here’s some helpful information to help make your tax prep a little easier.

Statements via US Mail

Statements via US Mail

- Printed tax statements will be mailed via USPS no later than January 31, 2021.

- Please allow 5-7 business days to receive your paper statements.

- Electronic tax statements for most account types will be available in Advantis Online Banking no later than January 31, 2021.

- If you’re registered for eStatements, we’ll email you when your tax documents are available.

- Typically, you’ll receive tax statements faster via Online Banking than US Mail.

- In addition to eStatements, you’ll also receive a hard copy via US Mail.

Other Tax Statement Information

- If you pay your mortgage via Midwest Loan Services, Midwest will mail your tax statements via USPS during the month of January. You may also retrieve them electronically from Midwest Loan Services. Log in from your Online Banking dashboard Quick Links, or go to midwestloanservices.com.

- If you pay your mortgage through Advantis, your tax statements will be mailed to you, or you can register for eStatements and access them via Online Banking.

- You must have paid more than $600 in mortgage interest for the year in order to receive a 1098 tax form.

Mortgage tax statement reminders:

- Statements include interest paid in the prior year, not the interest accrued.

- If you received COVID relief and skipped a mortgage payment(s), please be aware that interest continued to accrue during this time.

- RVs do not receive 1098s for interest paid, as they are not a mortgage. Use your December RV loan statement for needed year-end information.

- For interest-bearing accounts, you will not receive a 1098 INT if you earned less than $10.00 in interest for the year.

- IRA, ESA and HSA tax forms are mailed via USPS and will also be available by the end of January within Online Banking. 5498 forms are generated in May so prior tax year contributions, allowed until the tax reporting deadline each year, are correctly reported.

- Deferred Compensation tax statements will be mailed to you; these documents are not available in Online Banking.

Automate your refund or payment

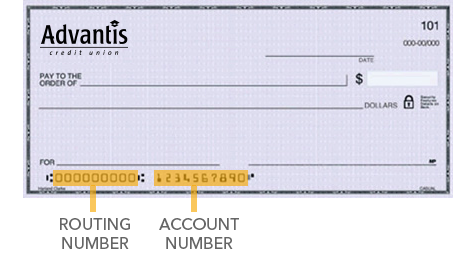

To ensure your tax refund or payment properly posts to your preferred account as quickly as possible, complete your state and federal tax paperwork using the Advantis routing number (323075181) along with your full electronic account number.Find them on your check

Use the Advantis routing and your account number listed at the bottom of your check.

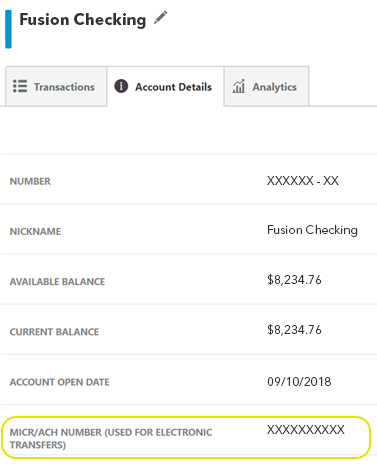

Find them in Advantis Online Banking

- Select the account you want to use for refund or payment

- Click on the ACCOUNT DETAILS tab

- Use the number listed for ELECTRONIC TRANSFERS/ACH, DIRECT DEPOSIT, CHECKS.

Questions?

Protect against fraud at tax time

With April 15 approaching, scammers and fraudsters are increasing their activity — from phony emails to spoofed telephone calls. Review these important tips to protect your personal information and accounts against fraud.

Swipe