Tax Statements

Planning ahead for tax season?

Here’s some helpful information to make your tax prep a little easier.

Statements via US Mail

- Printed tax statements will be mailed by January 31, 2024.

- Please allow 7 - 10 business days to receive paper statements.

Electronic statements

- Electronic tax statements for most account types will be available in Advantis Online Banking no later than January 31, 2024.

- If you’re registered for eStatements, we’ll email you when your tax documents are available.

- In addition, you’ll receive a hard copy via US Mail.

If you haven’t already, learn more and register for eStatements now.

Other statement information

- If you pay your mortgage via Midwest Loan Services, Midwest will mail your tax statements via USPS during the month of January. You may also retrieve them at midwestloanservices.com. Or go to Advantis Online Banking and select Midwest Mortgages from the Accounts & Loans drop-down menu.

- If you pay your mortgage through Advantis, your tax statements will be mailed to you. You may also register for eStatements and access them via Online Banking.

- You must have paid more than $600 in mortgage interest for the year in order to receive a 1098 tax form.

- Mortgage tax statement reminders:

- Statements include interest paid in the prior year, not the interest accrued.

- If you received COVID relief and skipped a mortgage payment(s), please be aware that interest continued to accrue during this time.

- RVs do not receive 1098s for interest paid, as they are not a mortgage. Use your December RV loan statement for needed year-end information.

- For interest-bearing accounts, you will not receive a 1099-INT if you earned less than $10.00 in interest for the year.

- IRA, ESA, and HSA tax forms, including 5498 forms, are mailed via USPS in January and will be available in Online Banking no later than February 28.

Automate your refund or payment

To ensure your refund or payment properly posts to your preferred account as quickly as possible, use Advantis’ routing number (323075181) and your account number. Please note, this is not your member number.

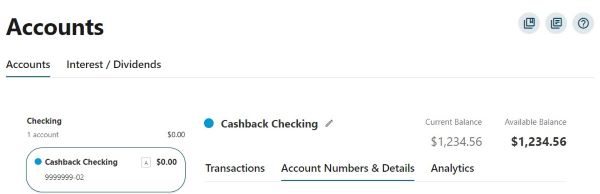

Find your account number in the Advantis Mobile Banking app or Advantis Online Banking.

- Click the account you want to use for refund or payment.

- Within the Mobile Banking app, click on Show Details.

- Within Online Banking, select Account Numbers & Details.

- Use the number listed for ELECTRONIC TRANSFERS/ACH, DIRECT DEPOSIT, CHECKS.

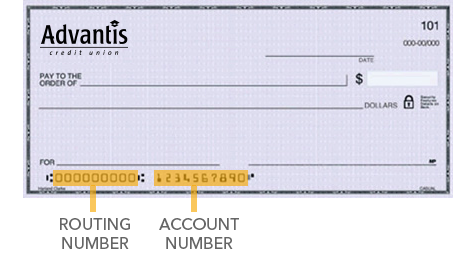

On your check

Find the Advantis routing number and your account number at the bottom of your check.

Find the Advantis routing number and your account number at the bottom of your check.

Swipe